At first glance, $0.15 doesn’t sound like much.

It’s the kind of fee most people wouldn’t think twice about.

But what if that tiny charge—less than the cost of a paperclip—was your ticket to building real wealth?

At Kamioi, we believe in full transparency. So here’s the deal:

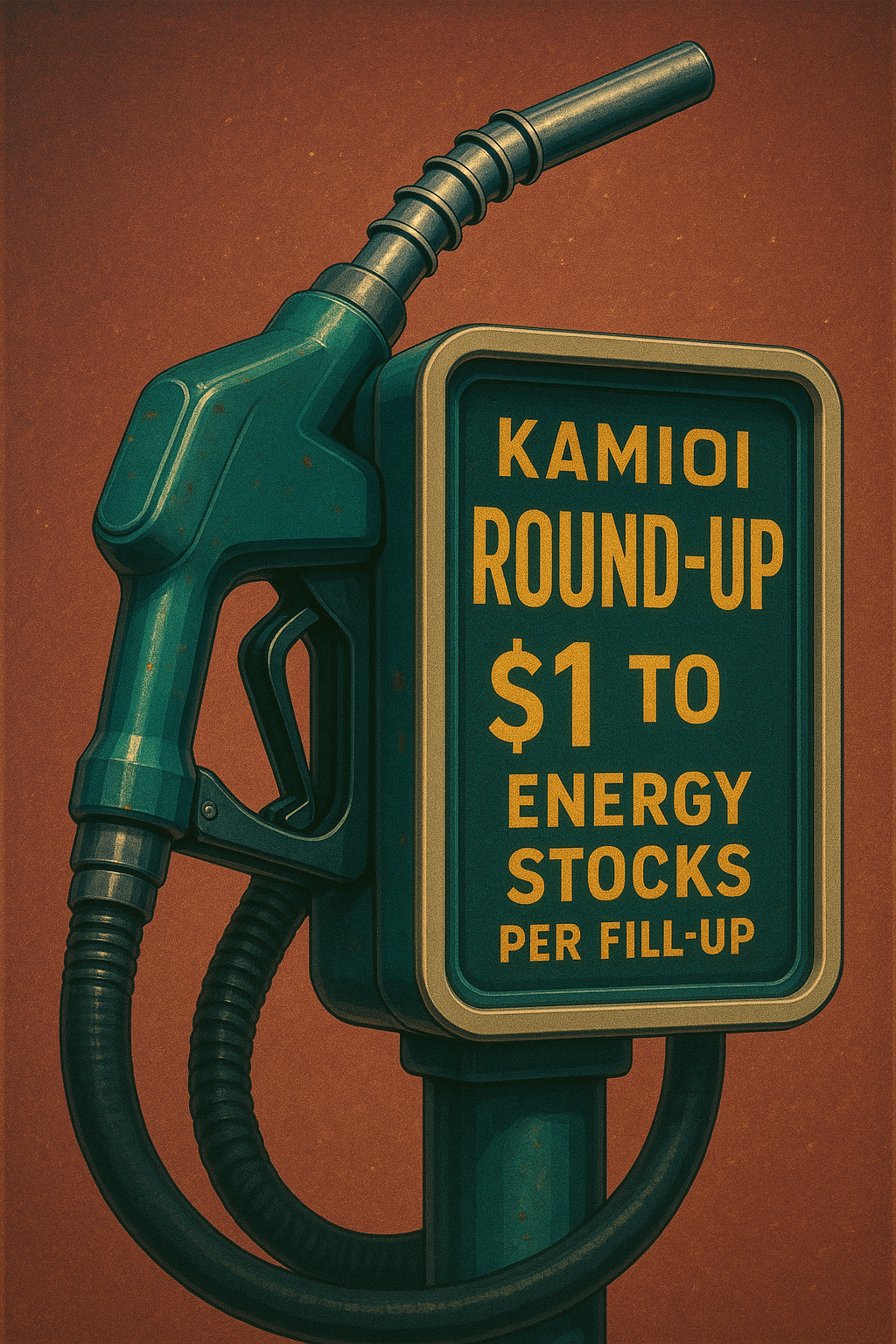

Every time you make a purchase with your linked card, Kamioi invests $1 into stock from the brand you bought from—or its parent company. Alongside that, we charge a $0.15 fee per transaction to keep the engine running.

But here’s what makes it powerful:

That $1 isn’t a fee. It’s your money being invested.

And the $0.15? It funds the technology helping you become an owner, not just a consumer.

What You’re Getting for $0.15

-

💸 Automatic $1 investments in public companies like Starbucks, Nike, Amazon & more

-

📈 Real-time portfolio tracking with personalized ownership goals

-

🧠 Passive investing education every time you spend

-

🛍️ No behavior change needed—just link a card, and spend like normal

Why This Matters

Most traditional investment platforms charge monthly subscriptions, trading fees, or require minimum deposits. Kamioi flips the model:

-

No subscriptions

-

No complex account types

-

No decisions to make

Just a flat, clear, $0.15 fee—and the rest goes to building your future.

The Power of Consistency

Let’s say you make 10 purchases a week. That’s $10 invested, and $1.50 in fees.

Over a year?

That’s $520 invested—in stocks you actually use—with just $78 in total fees.

Now imagine that compounding for 5, 10, 15 years.

Final Thought: Small Fees. Big Future.

At Kamioi, we don’t hide fees.

We keep them low, flat, and simple—because we’re not trying to nickel-and-dime you.

We’re trying to help you build wealth from your everyday life.

And sometimes, the smartest investments start with something as small as $0.15.

Recent Comments